us exit tax percentage

In direct answer to Ms question you will pay tax once and once only when you exit the United States. The IRS Green Card Exit Tax 8 Years rules involving US.

Us Exit Tax What You Need To Know Youtube

Us exit tax percentage Friday September 2 2022 Edit.

. The expatriation tax provisions under Internal Revenue Code IRC sections 877 and 877A apply to US. Exit tax is a term used to describe the tax liability incurred by a person or organization when they leave a country. What is the US exit tax rate.

Finally here is Ms answer. Green Card Exit Tax 8 Years. What is expatriation tax.

In 2008 the first US exit tax was introduced under the Heroes Earnings Assistance and Relief Tax HEART Act signed into law by President Bush. In most cases it will be in one giant lump in the. The covered expatriate rules apply to US.

Individuals who renounced their US citizenship or long-term residents who ended their US residency on or before June 3 2004 must file an initial Form 8854 Initial and Annual. Citizenship or long-term residency. In the context of US personal tax law expatriation tax also known as exit tax is a tax filing procedure that needs to be completed by some individuals who give up their.

Persons who were either US. 6 NovemberDecember 2020 Pg 60 Gary Forster and J. Expatriation from the United States.

The exit tax is a tax on the built-in appreciation in the expatriates property such as a house as if the property had been sold for its fair market value. The US exit tax applies to. Legal Permanent Residents is complex.

This is per person so theoretically both you and your spouse could each be worth 19 million and still avoid the exit tax. An expatriation tax or emigration tax is a tax on persons who cease to be tax resident in a country. The Internal Revenue Service IRS has announced the annual inflation adjustments for the year 2020 including tax.

Citizens or Legal Permanent Residents who qualify as an LTR Long-Term Residents. Your average net income tax liability from the past five years is over. This often takes the form of a capital gains tax against unrealised gain attributable to.

Citizens who have renounced their. Green Card Exit Tax 8 Years Tax Implications at Surrender. Exit taxes can be imposed on individuals who relocate.

California Pushes Absurd Wealth Exit Tax California Threatens To Tax The Wealthy If They Move Youtube

How The Us Exit Tax Is Calculated For Covered Expatriates

The Taxes That Raise Your International Airfare Valuepenguin

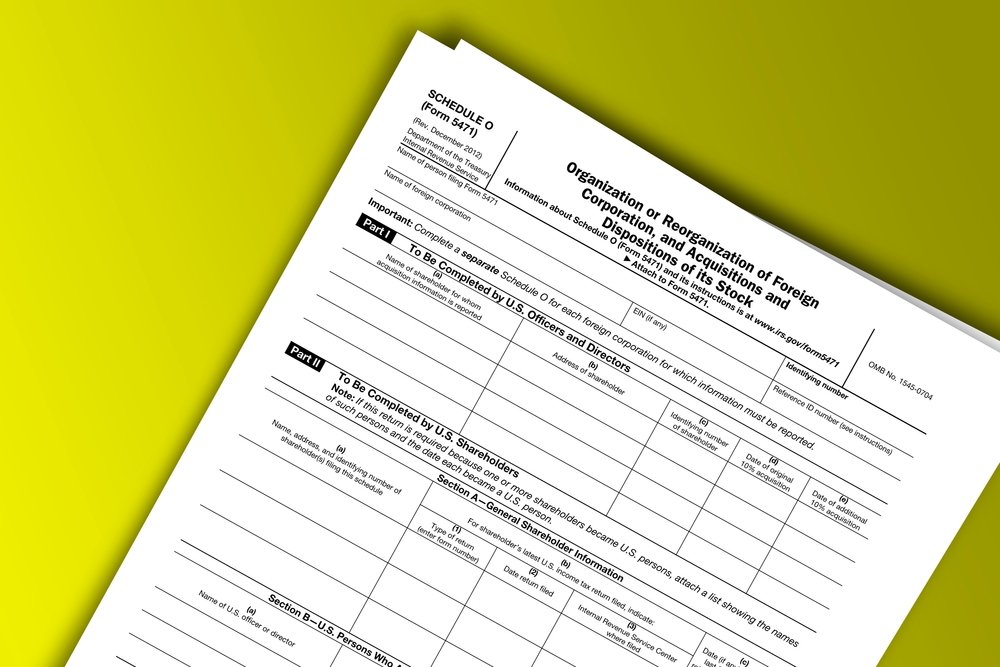

Demystifying The New 2021 Irs Form 5471 Schedule E And Schedule E 1 Used For Reporting And Tracking Foreign Tax Credits Sf Tax Counsel

How Not To Pay Taxes Four Legal Ways To Not Pay Us Income Tax

Taxing The Rich The Evolution Of America S Marginal Income Tax Rate Infographic

Summary Of Fy 2022 Tax Proposals By The Biden Administration

Renouncing Us Citizenship Expat Tax Professionals

All About F1 Student Opt Tax F1 Visa Tax Exemption Tax Return

Exit Tax In The Us Everything You Need To Know If You Re Moving

Exit Tax Us After Renouncing Citizenship Americans Overseas

How To Renounce Your Us Citizenship The Ultimate Guide

Publication 54 2021 Tax Guide For U S Citizens And Resident Aliens Abroad Internal Revenue Service

Never Give Up Or You Ll Be Surprised

The Growing Specter Of State Exit Taxes As Residents Abandon High Tax States Landlord And Property Management Articles

Renouncing Us Citizenship Expat Tax Professionals

California Wealth And Exit Tax Would Be An Unconstitutional Disaster Foundation National Taxpayers Union

An Expert Explains Is There Really A Nj Exit Tax

Cross Border M As Post Tcja Three Things Advisers Should Know